Remuneration is calculated and paid automatically, during the 2nd fortnight of each month, into the Lydia account of those who use it as their current account.

2% gross interest

This annual rate is applied to the amount that was present on all the customer's Lydia accounts (including money pots, and up to a maximum of €100,000 in total), for each day of the previous month, if the user has reached the minimum number of card transactions in the month (15 transactions per month, starting from 01/04/2024).

Calculation

For eligible users, Lydia takes the total balance of the accounts every day of the previous month and applies a rate of 2% gross per year.

(sum of all user's account on day 1 * 2%/365) + (sum of all user's account on day 2 * 2%/365) + etc

Conditions

Lydia card usage

The principle is to reward the use of Lydia as a current account. Therefore, are recompensated only:

- calendar months during which a Lydia card is used at least 15 times ;

- Lydia accounts with which a Lydia card can be used (i.e. not savings books or investment accounts).

Also, to avoid any misuse of the principle, card payments of less than €0.50, ATM withdrawals, and operations whose purpose is to credit an account of any kind are not taken into account in the calculation of remuneration.

French Tax Residents

Only French tax residents can benefit from the bonus.

Owned Lydia Accounts

Only Lydia accounts owned by the customer are considered. Money in a joint account can only benefit its creator for the bonus.

Accounts created for fundraising are also taken into account.

0,50 € net minimum

The amount of remuneration for one month must be at least €0.50 net to be granted.

Monthly Bonus Simulator (Gross)

The amount of the remuneration received each month varies based on the money present in the user's accounts each day of the previous month.

💰 Average balance | Remuneration |

€500 | €0,82 |

€1 000 | €1,64 |

€2 500 | €4,11 |

€5 000 | €8,22 |

€10 000 | €16,44 |

€50 000 | €82,19 |

Taxation

The bonuses received are subject to taxation in France.

Remuneration is paid net of tax (70% of the gross amount). Lydia takes care of the withholding tax (single flat-rate deduction of 12.8% income tax and 17.2% social security contributions), as well as the pre-declaration to the tax authorities. No action is required on the customer's part. Any remuneration received from Lydia will automatically appear on the customer's tax return for confirmation.

For more information, visit Remunerated Current Account Conditions

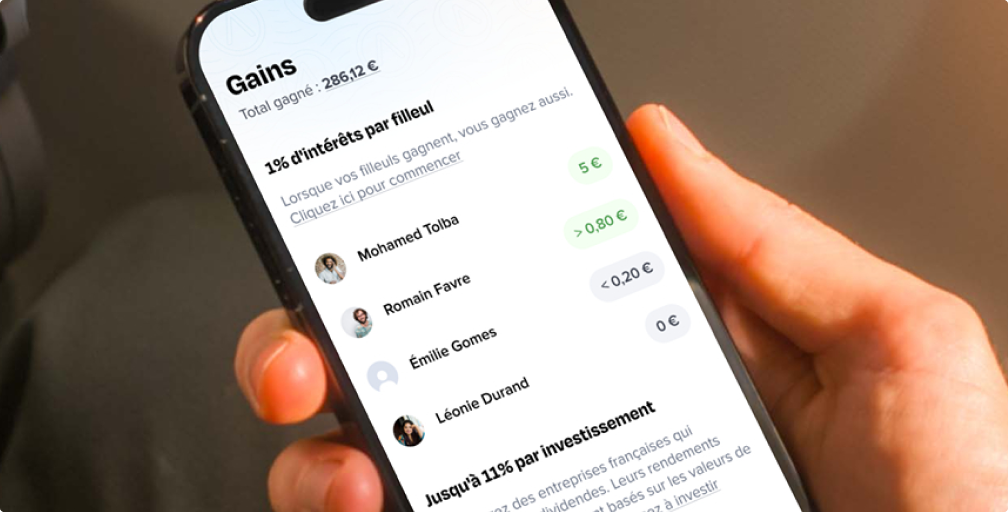

+1% gross interest per referee

The Lydia referral program allows customers who introduce and convert their circle to using Lydia as their current account to earn the equivalent of 50% of their referees' remuneration every month, as long as they receive a Lydia remuneration, for a period of 2 years.